3.1.2.2.7 Income Distribution

In the capitalist economy, the distribution of income is regulated by privileged owners of the means of production, whose subjectivity diminishes the contributions of workers in the process of production as much as they can, which creates the exploitation of workers, bringing problems to society

In socialism, the level of income of each worker is based on the objective price of labour and the achieved productivity. In socialism, equal human rights require the commune to provide income to all residents to secure their living.

All commune residents are involved in the income distribution system except workers in private companies because they retain their profits. Private companies will pay taxes like they do today. These taxes belong to the people of the commune. They are used, among other things, for the salaries of all the commune inhabitants.

The level of income can be determined by a coefficient with the following formula:

C-Income = (Work price) x C-income_W x C-income_E x C-income_C

Work price = (Value of past labour) x (Value of current labour)

The work price is determined by the product of the number of past labour points of a worker and the cost of current work. The quantity of points that each worker holds is equal to the value of their past labour and past work they inherited from their ancestors. The amount of labour past points is the specific condition of the system where the worker with a higher value of past labour realizes a proportionately higher income, irrespective of what work they are performing. Past labour points present a humanistic form of shares that will bring profit based on the value of past work. Such a profit may be significant, but it will not burden companies because it will be distributed on the commune level, as explained in the chapter “Commodity price.”

Each worker autonomously determines the price of current labour by comparing the work conveniences and inconveniences with other forms of work. They ensure the objectivity in valuing the current work price by the work competition where the right to work is exercised by the worker who, in the circumstances of equal productivity, asks for a lower current work price.

In socialism, all inhabitants realize the safety of their survival by income, and it is, therefore, necessary to also set the current work price of unemployed inhabitants. Since unemployed inhabitants of the commune do not perform any profit or non-profit job, they cannot autonomously set the costs of their current work (Every activity will be considered as work). The price of the current work of unemployed people will be determined by the commune’s leadership with the consent of the assembly of the commune. It will be done according to the commune’s working needs and economic possibilities. More precisely, to enable a balance between the supply of and demand for the work in the commune. If the commune’s inhabitants were not sufficiently interested in work, the leadership would reduce the price of current work for the unemployed population. This would result in their lower income, which would increase interest in the work of the inhabitants.

Conversely, if the interest in work by workers was excessive, the leadership may increase the current work price of the unemployed, and the workers’ interest in work based on income would go down. The commune management may give a higher price for current work to children and students, stimulating education. The commune’s social policy regulates the price of current work for invalids and older people. The people in this commune will no longer need a pension plan as retirement insurance because the new system provides individuals with an income regardless of whether they work. Besides, the individual will be able to work if they wish or can without limit of their age.

***

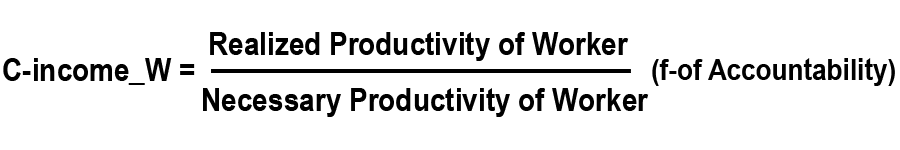

Finally, the level of income of each worker depends on the C-of income. The C-of income of each worker depends on the proportion of realized and envisaged productivity of workers, enterprises, and the whole commune in the function of workers’ accountability for the realized productivity. The following formula can present the C-of income of a worker:

C-income-W establishes the relation of the realized and envisaged workers’ productivity in the function of workers’ accountability.

Productivity is expressed in any accepted work values that indicate the quantity and quality of products in profit enterprises and services in non-profit work organizations. Where productivity cannot be precisely established by the quantity and quality of products or services, it can be determined by mutual evaluations of the labour productivity of workers. The system of assessment can be designed to allow the range of evaluations to indicate work productivity in the same way as in the case of the exact establishment of the quantity and quality of produced commodities.

The mutual assessment of inhabitants brings each inhabitant an equal power of decision-making, which introduces a new form of anarchic-democratic behaviour in the society. Thanks to equal assessing power, each individual may become both a prosecutor and the accused without the right to complain. The impact of individual assessment on the population’s income cannot be significant. Quite to the contrary, it will be minor because the accused will not have the right to defend themselves; however, it will be sufficiently strong to make people respect each other. Such respect will pave the way for significant conveniences in society. The assessment system will force the individual to diminish their shortcomings and augment their virtues in their behaviour toward the community in the broadest sense.

Suppose the realized productivity equals the necessary productivity, then the C-income-W = 1. In that case, the realized income will correspond to the envisaged income. If people do not receive any evaluation, they will be considered as they performed the needed productivity. If the realized productivity is higher or lower than the required one, the worker’s income will be higher or lower than the envisaged.

Finally, the C-income-W level depends on the C-responsibility of a worker determined by the workers themselves. Mathematically, a function can be defined that will bring the worker who declares small K-responsibilities approximately the income he sought regardless of the productivity achieved. With an increase in K-responsibility, his income will increase in the event of an increase in his productivity or decrease in the event of a reduction of his productivity. Higher K-responsibility gives more competitive power to do any work.

***

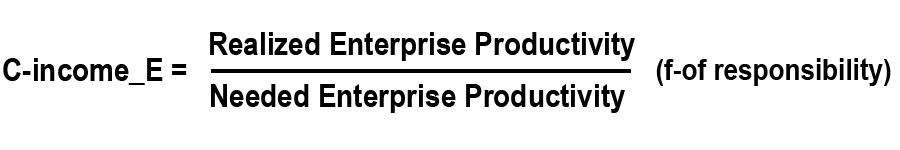

The income of workers will also depend on the productivity of the enterprise. Enterprise productivity may be shown the same way as a worker’s productivity. The formula may have the following form:

C-income_E establishes the relation of the realized and envisaged enterprise productivity in the function of the worker’s responsibility.

The productivity of enterprises is shown by the realized profit on the market. Profit represents the most efficient way for assessing productivity, or more precisely, the values of the result of work in present-day society.

Workers realize the envisaged income in the case of the realization of the envisaged productivity or, to say it differently, if they sell the current production on the market. But, of course, that would require a high speed in assets turnover or, practically, production for known customers. It is challenging to sell all the produced commodities during the accounting period. Some portion of such output will be sold in another accounting period, thus realizing its profit in another accounting period. However, it may be assumed that the commodities remaining from the past labour period are sold in the current accounting period and generate profit in the current period.

If the profit an enterprise realizes on the market is equal to the envisaged profit, then the C-income_E will be equal to 1 (one). The enterprise’s realized income will be identical to the envisaged. If the formula establishes a C-of income_E larger or smaller than 1 (one), then the enterprise’s revenue will be proportionately larger or smaller than the envisaged ones.

The system of work competition in the labour market ensures an even distribution of employment benefits and disadvantages in each company. But if one company has a significantly better means of production than another company, employees in the better-equipped company might achieve a higher income than workers in the company with outdated technology. In this case, workers would be more interested in working in better-equipped companies. Therefore, the commune’s leadership will organize production in enterprises of the commune so that an equal value of work based on productivity and past labour points achieves equivalent income. In this matter, managers may improve technology in companies with redundant equipment or may overflow the incomes between companies to ensure a uniform income interest of workers in all workplaces.

It is further possible to regulate with the coefficient of productivity other forms of success of the production, which cannot be presented by cash profit on the market, and which would handle: the protection of the environment against pollution, the deviation from standards of the quality of goods, etc.

States already have developed regulations that determine production norms, and socialism will intensify such standards. In addition, socialism will increase the efficiency of regulations. Special commissions will accept the state’s standards, analyze possible declines from them, and propose the intensity of influences of such declines on C-income_E. It will be crucial to consider all criteria for protecting the individual and their environment from pollution. This regulation will need to be accepted by the commune’s assembly. Based on such standards, the consumers of commodities, consumer associations, professional institutions, specialized arbitration commissions at the commune level or of the coalition of communes, or international arbitrations will evaluate the quality of work of economic enterprises.

It is noteworthy that the system does not envisage a bureaucratic evaluation of all producers because, in that way, an enormous bureaucratic administrative apparatus would be formed. Instead, the system envisages a customer’s free assessment of those enterprises whose products deviate positively or negatively from the determined standards. Every person will also have the equal power to evaluate companies. For example, suppose a person evaluates a positively or negatively a company that has 1000 employees. In that case, their evaluation will affect the reward or punishment of all these employees with 1/1000 of the impact that their evaluation would have on an individual. Such an assessment will be minimal but will exist and affect the improvement of production processes.

The system also provides the evaluation based on the analysis made by expert services of randomly selected or reported enterprises. The enterprises that do not get any assessment will be treated as they operate within the envisaged productivity and adopted economic operation standards.

Analogously to the profit realized on the market, the enterprises producing more socially acceptable products to the established standards will achieve a productivity assessment higher than 1, and realize a higher income. And vice versa, the socially unacceptable enterprises will realize an evaluation lower than 1, consequently, lower salaries. Calculation of the realized productivity may be presented in an indefinite number of factors that will, through mutual multiplication, give the final value of the coefficient K-Income_E.

By using the coefficients, economic enterprises can efficiently bear responsibility with their income for the pollution of the environment or bad quality of products. Enterprises polluting the environment or producing low-quality products will, dependent on the influence that such declines from the standards have, realize a lower income than they are supposed to receive according to the realized profit. Workers will also be additionally sanctioned by the loss of past labour points. To remove the shortcomings in their economic activity, such enterprises will have to compete for assets intended to develop the economy in the function of a non-profitable increase of productivity expressed by assessment.

Capitalism strongly opposes the protection of the human environment because it makes production more expensive. Socialism will provide a good quality of life to be accepted by the world one day. Then it will ensure that the Earth is clean and healthy.

Nonprofits generally do not have a measure of labour productivity. This group includes government institutions, education, health, and other service activities that do not generate income directly on the market but are funded by the budget.

Non-profit organizations should be placed under the same business conditions as for-profit companies. The productivity of non-profit organizations can be expressed by performance assessment. The assessment is given by service users, user associations and professional institutions. The evaluation of the performance of non-profit organizations can be presented with a coefficient as successfully as the presentation of the work of for-profit companies. Using coefficients, one can compare the performance of for-profit companies and non-profit organizations and, based on that, reward according to the values of work performed.

In the associated labour, each work is non-separable from another job, so that each worker also bears responsibility for the economic activity of their enterprise. A worker stating a higher coefficient of responsibility also assumes greater responsibility for the enterprise’s productivity and will realize a higher income in the case of the enterprise’s rise in productivity, and vice versa.

***

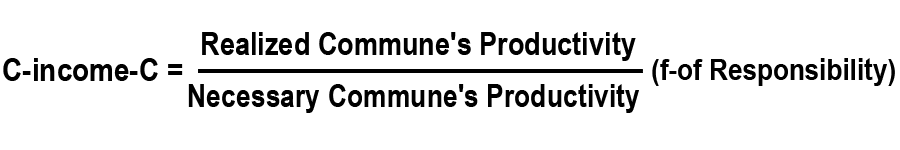

Inhabitants of the commune are responsible for the productive orientation of the commune. Therefore, the coefficient of the commune’s realized productivity can be expressed by the following formula:

C-income_C establishes the relation of the realized and envisaged productivity of the commune in the function of responsibility of each worker.

This coefficient does not strongly impact the distribution of income within the commune. Differences occur only vis-à-vis the degree of responsibility an individual worker assumes for their own and collective productivity. Nevertheless, the establishment of the C-of realized productivity of the commune would be highly important in the association of the communes and the distribution of income among the communes.

At the commune level, productivity is expressed by the economy’s revenue. It is possible to expand the measure of the commune’s productivity by a poly-functional system that evaluates the quality of life such as pollution-non-pollution, literacy-illiteracy, legality-illegality in the acting of the population. By using C-income_C is also possible to make subventions to less-developed communes. That would increase the interest of workers in working in such communes. In the same manner, regulating even the birth rate of the commune population will be possible. If the commune has too low or too high a birth rate, it may be adjusted by C-income_C by an appropriate value.

The definition of such categories and their regulation will be the task of the state parliament. Defined categories of the coefficients of values would allow a more efficient implementation of social, economic, ecological, cultural, and all other policies of associated communes.

***

The income of each worker in socialism and of the commune’s inhabitants can be presented by the following formula:

C-income = (Work price) x C-income_W x C-income_E x C-income_C

It clearly arises from the formula that C-of income of each worker depends on the envisaged work price and the coefficient of realized productivity at the level of the work post, enterprise and the commune, in the function of responsibility for the realized productivity. By applying computer technology, the level of income of all workers can be quickly calculated, regardless of the number of factors determining the income. A worker who, for example, realizes a 10% rise in productivity at their work post in the enterprise that registers a 5% drop in productivity, will realize a C-income of about 5% higher. It may be assumed that workers will be most responsible for their own work because oscillations in the enterprise productivity are smaller, while they are minimal at the level of the commune.

The above socio-economic system represents a shareholding-social, or more precisely, a humanistic form of ownership of the means of production; however, it also allows the production of independent private entrepreneurship. Private entrepreneurship understands an independent production where the means of production are in private ownership. Work posts in private entrepreneurship are owned by private entrepreneurs, and are not subject to work competition. The owner of an enterprise employs workers according to their needs and possibilities.

Upon realizing cash profit on the market, private entrepreneurs keep working cash assets according to their needs. They also keep cash assets for the upgrading and amortization of the production. They are bound to pay income tax, and property tax as is the case today. These cash assets are intended for the employed workers in the non-profit economy, unemployed workers, the commune’s collective consumption, and the federal consumption. The tax level for independent private entrepreneurs will be identical to the taxes of the associated labour. The population of the commune will directly determine the level of appropriations. The owner of a private enterprise may decide to autonomously determine the income level of their workers and pay them autonomously, or may integrate into the collective distribution of incomes of the commune’s inhabitants.

If an independent private entrepreneurship uses in its work a production technology unknown to the public, and realizes through the use of such technology a cash profit higher than the associated labour with the shareholding-social or humanistic ownership of the means of production, it will realize a higher income. Such private entrepreneurship can survive and attract labour force in the new system as well.

However, the newly proposed economy will invest money in its development as much as it is needed. The system of work competition will develop the economy to such an extent that it will become more productive than independent private entrepreneurship. When independent private entrepreneurs realize incomes lower than enterprises in the collective ownership, the number of workers interested in employment with private entrepreneurs will drop. In addition, if we take into account the right of workers to freely choose the work they want, to make all decisions about their work, to choose their salaries, and to share the profits of the companies that the new system offers, the number of workers interested to work with private enterprises will be even lower. In short, the new system will out compete the private companies from the free market and take over their workers. It may be expected with high certainty that independent private entrepreneurs will surrender the ownership of the means of production to the society in exchange for an equivalent quantity of past labour points. A larger number of past labour points will ensure a higher income, a stronger competitive power in choosing work, and therefore a stronger power in the society.

***

The money intended for incomes of all inhabitants is formed at the level of the commune’s administrative centre from the revenue of the commune. The quantity of money is determined by direct voting of the population and is appropriated from the total amount of money intended for the turnover of commodities in the commune.

The obtained amount of money intended for incomes of the commune’s population needs, in principle, to correspond with the envisaged quantity of money intended for the incomes of the population, because the system is based on the price of work corresponding to the income of workers. However, deviations are possible due to differently realized productivities. Therefore, there might be more or less money available for the overall income of all inhabitants in comparison with what the system originally anticipated.

Such deviations will be adjusted in the manner that the whole amount of money for incomes be distributed among workers proportionately to the defined C-income of workers. In this way, the shortage or surplus of money intended for incomes cannot exist. Bank loans will no longer be needed to cover a lack of money. The amount of money intended for income will be distributed to people in proportion to their share in production and everyone will be convinced that the distribution of incomes is fair.

The technique of income distribution may take place from the commune’s computer centre. Actual income can be established according to the extended proportion formula:

Income-1 : Income-2 : Income-2 : … : Income-n =

C-income_1 : C-income_2 : C-income_3 : … : C-income_n

From the overall quantity of money envisaged for incomes and the shown extended proportion that may include millions of members, by using computer technology, the income of each worker can be quickly and precisely calculated in the form of:

Income-1 = Value-1

Income-2 = Value-2

Income-3 = Value-3

…

Income-n = Value-n

The obtained income shows the operating result value of each commune’s inhabitant in a certain monetary amount.

Centralization of the income distribution systems allows the application of uniform distribution criteria according to the principle that equal incomes pertain to equal work. The profit that in the classical economy brings conveniences to the owners of the means of production is now, in a socially acceptable manner, distributed to all inhabitants of the commune. Exploitation is no longer in place.

No work is independent and, therefore, income arising from the collective operation result needs not be independently distributed. Income distribution by means of prolonged proportion and coefficients allows that the entire quantity of money intended for incomes in the commune is elastically distributed among the commune’s workers and inhabitants, proportionate to with the price of the invested labour and the workers’ responsibility for the realized production, without a surplus or deficit of money assets in the annual balance sheet.

Possible abrupt changes in the realized income of workers due to a high increase or strong decrease in productivity may be amortized by a mathematical function that will not allow a sudden rise or sudden fall of income, which would contribute to a more steady economic stability of the society.

The final say in income distribution has to be that of the commune’s inhabitants by their direct statement of the minimum income level. The obtained mean value stated by all inhabitants in the function of their decision-making voting power would represent the guaranteed survival subsistence minimum that each worker or inhabitant of the commune receives in the accounting period regardless of the size of their share in the production, and the price of their work.

A lower minimal income of inhabitants would with the established income-related amount of money intended for all incomes create a larger range among incomes, which would increase work engagement and, accordingly, the productivity of the economy and social standard. The high standard and high productivity can result in saturated markets, which diminish the working needs. The population then could, by its own free will, increase the minimal income of the population, thus reducing the range among incomes, and the workers, due to the decreased income-related stimulation in the process of production would reduce their own work engagement to the point where the supply and demand of work would come into balance.

The corrections can be applied by the computer technology easily and rapidly, where the smallest C-of income would ensure a democratically established minimal income. Application of the extended proportion will proportionately increase or decrease the differences in the level of income, according to the needs of the society.

This requirement finalizes the complex approach to the establishment of income distribution of the commune’s inhabitants excluding the workers in private enterprises who would keep their profits. The obtained value expresses the definite final income value and also the purchasing power of inhabitants in the commune. Incomes of workers may be presented to the public or kept secret depending on the wish of the people and every individual. Each inhabitant uses their own income according to their free wish.